What Is a Good Credit Score in Canada? Ranges, Factors, and Tips to Improve

What Is a Credit Score and Why Does It Matter?

A credit score is a three-digit number that represents your creditworthiness and potential credit risk. The higher your score, the more likely you’ll be approved for a mortgage, higher lines of credit, lower interest rates, and additional investments. Alternatively, a lower credit score can prevent you from getting a mortgage or other loan approval and typically results in higher interest rates.

Some benefits of holding a good credit score in Canada include:

Higher approval rate for credit cards

More likely to be approved for a mortgage loan

Higher loan approval

Lower interest rates on lines of credit and loans

Higher credit limit approval

Higher approval rate for renting

Useful for cell phone contracts, car insurance rates, and avoiding utility security deposits

So, what makes a credit score good, and what makes it bad? Let’s start with the basics.

What Is a Good Credit Score in Canada?

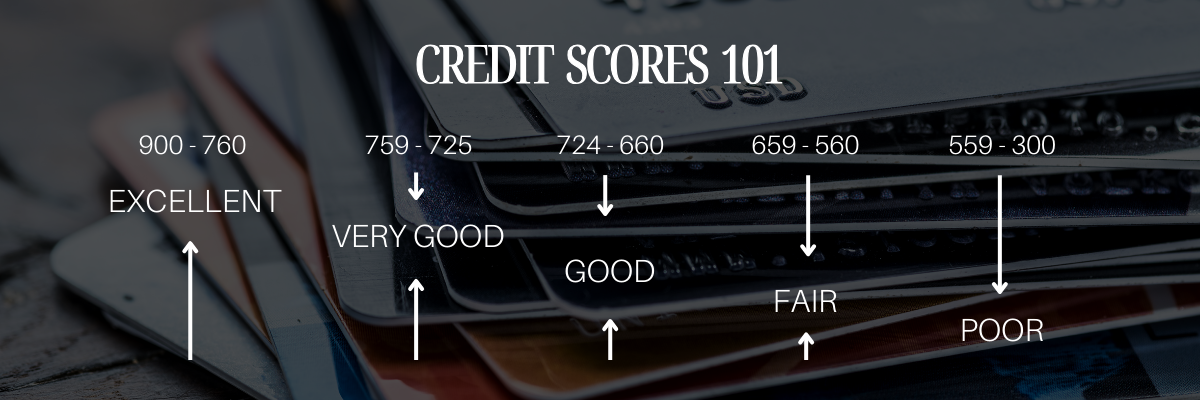

Credit scores range from 300 to 900, with 900 being the highest. An excellent credit score typically falls between 740 and 900, while anything below 580 may be considered a poor credit score. Here’s the full breakdown:

760–900: excellent credit score (best rates, easy approvals)

725–759: very good

660–724: good (often enough for many mortgages with decent rates)

560–659: fair (may still qualify but with conditions or higher rates)

300–559: poor (higher risk, more denials, higher interest rates)

With a score of 850-900, borrowers will have missed little to no payments and typically pay their monthly credit balances on time and in full. These higher scores result in fast approvals for high loan (i.e. mortgage loans) and credit limits, plus the lowest available interest rates.

Bonus: With a consistently high credit score, you may receive access to premium cards and credit benefits that higher-risk users cannot access.

What credit score do you need for a mortgage or rental?

Most lenders and landlords like to see a credit score of about 660, but it depends on the lender and your complete buyer or tenant profile.

Keep in mind: A good credit score doesn’t guarantee approval, but a poor one can absolutely block you.

Factors that affect your credit score

While we try to avoid it as best as possible, encountering point deductions throughout the lifespan of your credit history is expected. Deductions typically occur if you have a collection of late payments, a consistently high credit utilization ratio, or any loan-related issues.

On the other hand, positive information can work in your favour just as strongly. Consistent on-time payments, responsible credit use, and a long, well-managed history all help strengthen your score month after month. These positive patterns show lenders that you’re reliable, stable, and capable of managing financial obligations, which ultimately leads to better approvals, better rates, and more financial opportunities.

Factors that positively impact your credit score

Long, well-managed credit history: The longer an individual’s credit history is, the more information there is to exemplify their creditworthiness or their credit riskiness. Getting a credit card allows you, the borrower, to begin building a history of financial stability, which carries you forward through your most significant financial transactions.

Consistent on-time payments: Timely payments can help your score remain high and stable since they demonstrate your ability to manage and maintain the payment expectations of your lender.

Low credit utilization (ideally under 30%): Credit utilization is the amount of your credit limit you’ve used and still owe at the moment your statement closes each month. The higher your credit utilization is, the more likely it is to negatively affect your score since it may indicate that you’re using credit outside of your means. A solid rule of thumb for maintaining a high credit score is to stay within 30% of your credit limit.

A healthy mix of credit types: Using your credit card for various transactions can produce a diverse credit history, which can help your lender better understand your spending habits.

Few recent hard inquiries: Hard credit checks occur when a lender reviews your credit history if you apply for a loan or a credit card. Multiple hard checks within 14 days are treated as one inquiry, which likely won’t affect your credit score, but too many hard checks beyond 14-day periods and within a short timeframe can send the wrong message to your lender.

Keeping older accounts open: Older credit accounts increase the average age of your credit history, which boosts your score and reflects long-term financial consistency.

Paying more than the minimum when possible: Making larger payments helps reduce your balances faster, lowers utilization, and signals strong repayment behaviour.

Using credit regularly but responsibly: Credit utilization on a regular basis for different product types provides lenders with a line of history that creates trust and eliminates signs of riskiness that could negatively impact your score.

Factors that negatively impact your credit score

Late or missed payments: Even one missed payment can lower your score because it signals difficulty meeting financial responsibilities.

High credit utilization (50%+ or maxed-out cards): The higher your credit utilization is, the more likely it is to negatively affect your score since it may indicate that you’re using credit outside of your means.

Accounts sent to collections: Collections show that debts were left unpaid long enough to require outside intervention, which is seen as risky credit behaviour.

Bankruptcy or consumer proposals: These events can impact your score for years as they indicate serious financial distress and represent a high level of risk to lenders..

Frequent hard inquiries across many different lenders: Multiple applications in a short period can make it appear that you’re seeking new debt aggressively or experiencing financial instability.

Short credit history: With limited data, lenders can’t fully assess your reliability, which can keep your score lower until you build more history.

Closing old accounts: Closing accounts reduces your total available credit and shortens your average credit age, both of which can lower your score.

High balances on multiple cards at once: Carrying high balances across several accounts suggests you're over-leveraged and increases the likelihood of missed payments.

Delinquent or defaulted loans: When loans go unpaid, it signals a major inability to meet obligations, severely damaging your creditworthiness.

How Long Does Information Stay on Your Credit Report?

Positive information, such as on-time payments and well-managed accounts, can stay on your credit report for up to 10 years, depending on the credit product. Negative details, including late payments or debt sent to collection, can remain on your report for up to six years.

Here’s a detailed breakdown of the most common types of information found on a credit report and their typical lifespan:

On-time payments: Up to 10 years

Late payments: Up to six years

Accounts sent to collection: Up to six years

Closed accounts in good standing: Several years

First-time bankruptcy: Six to seven years

Second-time bankruptcy: 14 years

Consumer proposals: Three years after the proposal is paid off or up to six years total

Hard inquiries: 3 years (Equifax) or up to 2 years (TransUnion), but usually only impact your score for the first 12 months.

Soft inquiries: Up to 24 months, but do not affect your score in any way.

Keep in mind: Equifax and TransUnion follow similar rules for most items, but some timelines (such as hard inquiries or certain public records) may differ slightly between the two. Lenders may use one or both bureaus, so it’s helpful to check both reports periodically.

How to improve your credit score

On-time payments, low credit utilization, and limited hard checks are some of the best ways to increase your credit score over time. Here’s a step-by-step guide to help you optimize your credit score.

Step 1: Review your credit report and identify red flags

Begin with taking a good look at your credit report to depict sites of riskiness. You can request a free copy of your credit report annually, online from Equifax or TransUnion.

Keep an eye out for errors in personal information, accounts that don’t belong to you, or incorrect late payments. If you see any disrupting errors, you can dispute them directly with the bureau.

Once you’ve reviewed and understand your history and errors, you can move forward with a plan for increasing your credit score.

Step 2: Prioritize On-Time Payments, Every Month

Paying your bills on time is one of the strongest tactics to help improve your credit score and build a good report for your future goals. For example, when lenders see a strong pattern of on-time payments, they’re more confident in approving you for a mortgage or a better rate.

Best practices include setting up automatic payments or reminders to stay on track with your bills.

Step 3: Lower your credit utilization ratio

Lower credit utilization indicates that you spend within your means, so it's best to keep it below 30% when your statement closing date comes around.

Step 4: Be strategic about new credit and hard inquiries

Hard checks occur when a lender reviews your credit history if you apply for a loan or a credit card. Multiple hard checks within 14 days are treated as one inquiry which likely won’t affect your credit score, but too many hard checks beyond 14-day periods and within a short timeframe can send the wrong message to your lender.

Best practices include conducting all your hard-check ventures within 14 days to avoid further credit score penalties, and avoiding applying for multiple new cards or back-to-back loans within a short period of time unless it’s necessary.

Step 5: Create a debt repayment plan

Whether you set up a payment plan with your lender or create an independent plan on your own, it's wise to proceed with caution and have a plan in motion to help you stay organized, avoid missed payments, and bring your balances down efficiently.

Here are a few debt repayment plan options that can help:

Snowball method: Focus on paying off your smallest debts first while making minimum payments on everything else. Each paid-off debt creates momentum and builds confidence as you work your way up.

Avalanche method: In multiple-debt situations, focus on delinquent and high-interest accounts before proceeding with lower-level debts.

Debt consolidation loans: Combine multiple high-interest debts into one loan with a lower interest rate. This makes payments more manageable and helps reduce the total cost of carrying debt.

Using Home Equity or Refinancing Strategically: For homeowners, using available equity or refinancing to consolidate high-interest debt can lower monthly payments and reduce financial pressure. However, this should be done carefully (ideally with guidance from a mortgage professional) to ensure long-term stability and avoid putting your home at risk.

Step 6: Think Twice Before Closing Old Credit Accounts

It can feel tempting to close a credit card as soon as you pay it off, but doing so may unintentionally hurt your credit score. Old accounts play an important role in how lenders evaluate your financial history.

Here’s why keeping older accounts open often helps your score:

They increase the average age of your credit: The longer your credit history, the easier it is for lenders to assess your reliability. Closing older accounts shortens your overall history and can lower your score.

They contribute to your total available credit: When you close an account, your available credit decreases. This can raise your credit utilization ratio even if your spending stays the same, which may negatively impact your score.

How to check your credit score in Canada

In Canada, you have several free and paid options to check your score and review your full credit report.

Annual free credit report (no impact on score): Every Canadian is entitled to receive a free copy of their credit report once per year from each of the two major credit bureaus; Equifax Canada and TransUnion Canada. You can request these reports by mail or online. These reports do not include your numerical credit score unless you choose a paid upgrade, but they provide the full breakdown of your credit history, including accounts, payment patterns, inquiries, and any negative marks.

Free credit score access through banks & financial apps: Many major Canadian banks and financial tools now offer free access to your credit score directly through their online banking apps.

Paid credit monitoring services: Both Equifax and TransUnion offer paid monthly subscriptions that include instant credit alerts, daily or weekly score updates, identity theft protection, and access to both your score and your detailed report. These plans can be useful if you're actively rebuilding your credit or preparing for a mortgage application.

Does Checking Your Credit Score Hurt Your Credit?

No, checking your own credit score is considered a soft inquiry, which do not affect your credit score in any way.

Soft checks include:

Reviewing your own score

Viewing your credit through your bank app

Employer background checks

Pre-approval credit assessments

Only hard inquiries, like applying for a mortgage, credit card, or loan, can temporarily impact your score.

Regular monitoring gives you a clear picture of your financial health and allows you to catch errors early, address red flags, and plan strategically for major purchases like a home.

Next Steps

Planning to buy, refinance, or get mortgage-ready in the next 6 to 12 months? This is the ideal time to strengthen your credit profile and position yourself for the best rates and opportunities.

For personalized guidance or answers to your situation, reach out to me on Instagram or book a call below! I’m here to help you move confidently toward your goals.